How To Make A Budget And Stick To It

Failing to plan is planning to fail – Benjamin Franklin

If you don’t have a budget, you are living dangerously. You have either fallen off the proverbial financial ship or are taking on water and sinking slowly without even realizing it. It’s time to learn how to make a budget and stick to it.

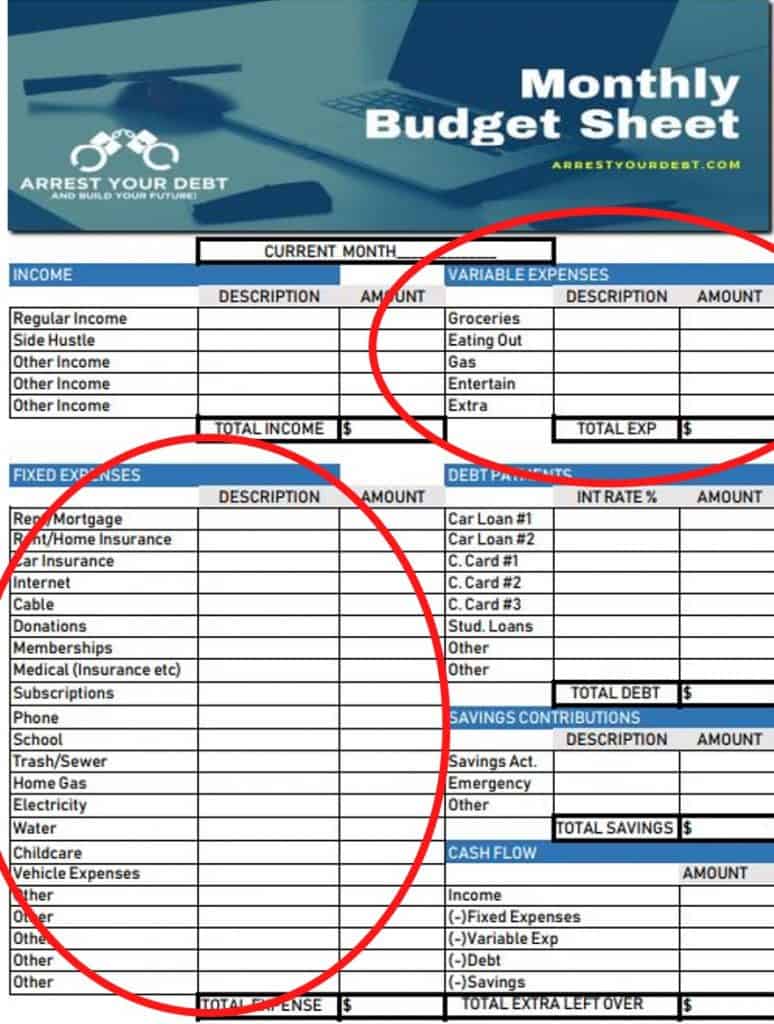

This article is a step by step introduction for how to create a basic budget so you can improve your financial situation. Before we start, get your free budget printables here. This free budget worksheet will help you get your finances on track.

This article includes everything you need to know to get started with a monthly budget. If you have a savings goal you are trying to hit or are tired of living paycheck to paycheck, a budgeting plan is the first step to reach financial freedom.

The best personal finance advice I ever received is “personal finance is personal.” Each person’s budget will be different from the next one.

Your budget is the first step in taking control of your life and finances to eliminate your debt and begin building wealth. When I was younger, I didn’t believe in a budget. My main goal was to spend less than I made each month. If I still had a couple of bucks left in my checking account at the end of the month, I considered that a win.

Now that I look back, I was not winning; in fact, I was losing every month. I was working hard, but I wasted my money on things that didn’t bring me value. I was not telling my money where to go, and instead, I was always wondering where it went.

Why You Need A Budget

Budgets have a negative connotation with them, don’t they? In my early days, budgets meant no fun. All work and no play is awful, and I felt a budget meant no eating out, no video games, and no freedom in general. I felt budgets were restrictive, and I worked too hard not to enjoy my hard-earned money.

Perhaps you feel the same way?

I have heard countless remarks from friends who state, “I can’t take my money with me,” or,

“Why shouldn’t I have fun with my money now while I’m young and healthy? Who knows what could happen in the future, I could die or become sick and be unable to enjoy life.”

This rationale is based on the fear of the unknown and burying your head in the sand to ignore a problem. If you live in the moment, you will have no future when it comes to your finances. Living like you’re rich now means you may be living like a pauper when you’re older.

If you fail to plan for your future – you will not have one. Can you afford to live on social security alone when you get to your golden years? Some people survive on social security alone, but I certainly wouldn’t consider it “living.”

If you live for 20 years after retirement by relying on a pension alone, the cost of living raises may not keep up with inflation. In reality, your golden years will not be so bright if you live for today and ignore tomorrow.

The Basic Steps For How To Make A Budget

The truth is, you can have a budget and enjoy life at the same time. There is a secret budget fund known as “fun money.” This fund allows you to spend money on junk – just because you can. It gives you an outlet to be a little less responsible while being responsible at the same time.

My wife and I each have a set amount of fun money we get each month. It’s an amount of money set aside in the budget that we get to spend on whatever we want without any guilt.

That means I can either spend all that money each month on junk food and video games. I can also decide to save it up and buy something totally ridiculous that would generally be a waste of money. With fun money, I can do this without any guilt or credit card debt. Your budget is what you make of it. A budget tells your money where to go, rather than wondering where it all went.

Budgets should be reviewed monthly

So how do you make a budget? Budgets should be written down and reviewed each month because monthly income and bills may change. A budget is not a set it and forget it type of plan. You must at least look over your budget each month to make sure nothing has changed, and you’re still on track to reach your financial goals.

While a budget may sound intimidating, there are a few necessary steps to create a budget, and I will break them down for you.

Full disclosure: the first month you do a budget, it will be very time-consuming. However, after a couple of months, you will get the hang of it, and your monthly budget will only require a few minor tweaks. So without further ado, here are the steps to make a budget and stick to it.

How To Create A Simple Budget

- Pre Budget: Find Your “Why”

- Step 1: Determine Your Minimum Monthly Take Home Pay

- Step 2: Write Down Your Monthly Expenses

- Step 3: Cut Out Unnecessary Expenses And Build A Strategy

- Step 4: Use Your Budget To Get Out Of Debt

- Step 5: Fully Funding Your Retirement Account

Pre-Budget: Find Your “Why”

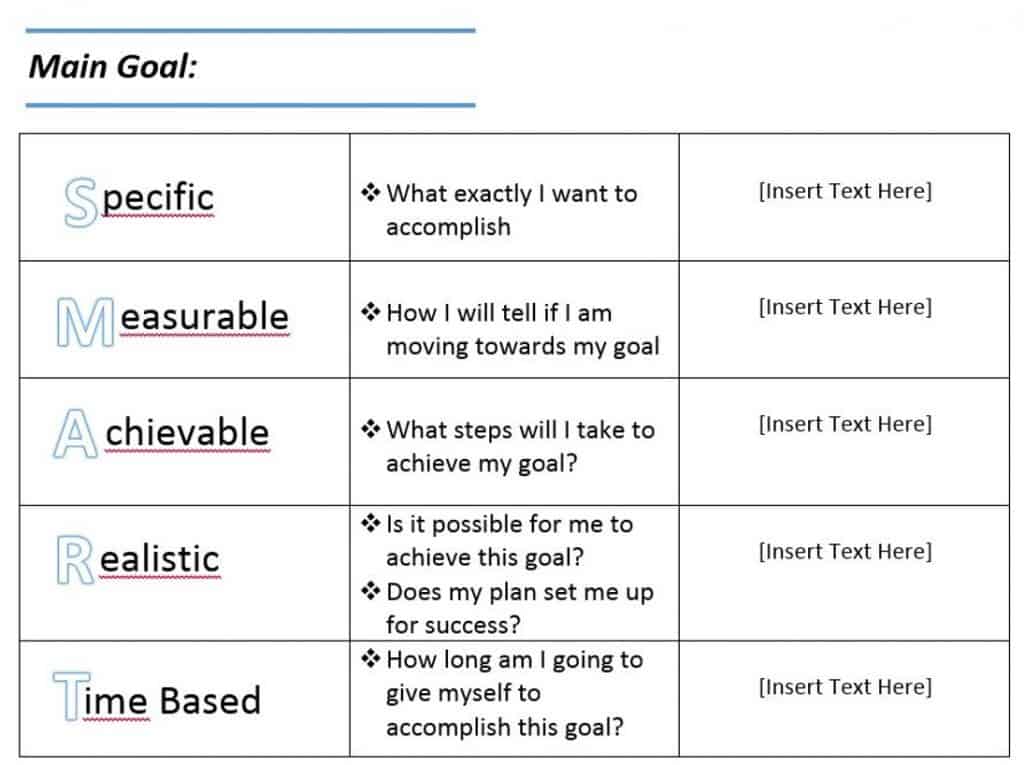

Before you sit down and go through the motions of creating a personal budget, you need to truly understand your “why.” What are your goals and dreams? Maybe you want to live on a beach when you retire, or perhaps you want to buy that big truck you always wanted. Whatever your life goals are, they are all tied to money in some way or another.

By establishing your why and setting goals (Pro Tip: write them down on paper), you will help make your budget work for you, rather than wonder why you work so hard and are always living paycheck to paycheck.

Once you have your why, it’s time to get to work.

Step 1: Determine Your Minimum Monthly Take Home Pay

Estimate and write down as close as you can, to the exact dollar, how much income you expect to receive next month. Not what you wish or hope for, but the minimum amount of income you are guaranteed to receive in your regular paycheck. Go over your past few months of pay stubs to determine the monthly average income you receive regularly.

If you have irregular income or variable income, you can take your salary for a whole year and divide it by 12 to give you a starting place. If you are salaried, the prior month is a great reference point.

When you get this number, work on filling out your budget printable to ensure it all makes sense in the end. Your total income may end up being more than what you budgeted for, but it’s always safer to go off your minimum net income (after-tax income).

Step 2: Write Down Your Monthly Expenses

Next, write down all your monthly bills by going over your bank account statement from the previous month and putting them into budget categories. These bills will be fixed expenses (recurring expenses) or irregular expenses, which may include:

- Auto Loan

- Gas Bill

- Child Support

- Electric BIll

- Medical Bills

- School Expenses

- Internet Bill

- Utility Bills

- Household Bills

- Cell Phone Bill

- Home Loan

- Cable Bill

- Car Insurance

- Home Insurance

- Monthly Grocery Expenditures

- Union Dues

- Membership Fees

- Debt Obligations

- Credit Card Minimum Payments

- Student Loan Minimum Payments

- Any other living expenses you are required to pay each month

Look over your past bank and credit card statements to get an accurate picture of your spending habits. This first exercise aims to give you an average amount of how much you spend each month compared to how much money you make each month.

Certain services have annual memberships or yearly bills. For instance, if you pay your insurance bill every six months or annually, divide the total payment by six or twelve and include it in your monthly expenses.

Now that you have all those required payments, you need to think about those other expenses that come up every month such as household items to include: toothpaste, deodorant, shampoo, haircuts, other personal grooming products, gas for your vehicles, necessary clothing items that may need to be replaced, etc.

These items can be combined into one section labeled household or personal hygiene etc. This will be a tedious process, and will probably take everything in you not to quit, but please believe me when I say that the first month is the most difficult. If you stick to it and get it all down on paper, amending it will be much less time-consuming in the coming months.

Totaling up your monthly expenditures

Finally, when you have everything written down that you can think of (trust me, in a week, another monthly expense will come up that you forgot about), add them all together and compare your income to your costs. This may be the first time you have ever seen how much you spend compared to how much you bring in each month.

If you have credit card debt or other unsecured debt, you should add these in as a bill based on the minimum amount you must pay each month. Once you understand budgeting basics, we will later move on to getting out of debt as soon as possible.

I realize this may either be an “oh crap” moment or a “hey that’s not too bad” moment, but either way, we are still not close to what you really spend each month. We haven’t included how much we spend on entertainment and other variable expenses. This is just a starting point.

Step 3: Cut Out Unnecessary Expenses And Build A Strategy

The next step in your budget is to develop a strategy to curb any poor spending habits and put your money towards things that bring you value. Hopefully, after putting in your income, monthly expenses, and minimum debt payments, you still have cash flow and a little extra money left over. If not, get out the scissors and start making some spending cuts.

Your comprehensive budget should not only give you a clear picture of what your financial situation looks like, but it should also be a plan. A successful budget will make it easier to identify what you are doing right and where you can improve and cut back.

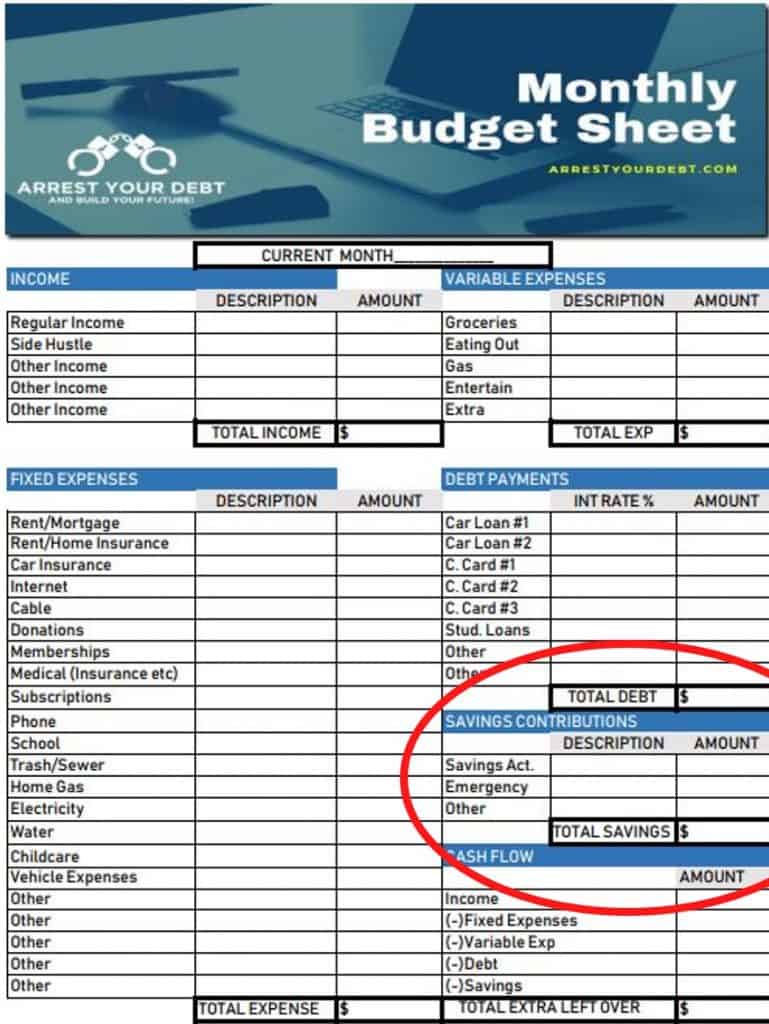

Emergency Fund

Once you cut back some of your expenses, your number one priority should be an emergency fund of $2,000. An emergency fund is your insurance against an unexpected expense, such as a vehicle breakdown and repair. By funding an emergency fund, you can avoid charging these problems on a high-interest credit card by paying for them in cash.

Your financial strategy should be to make the minimum monthly payment on all of your debts and expenses until you have saved $2000 in a separate savings account.

Needs and Wants

Now, if you have not already, it is a great time to start looking at your expenses to see what you can cut out and what does not bring value to your life. Try writing “needs” next to your minimum living expenses, and “wants” next to things that are not needed to keep you alive.

Pop Quiz: Are premium cable television channels a need or a want? Let’s be honest with ourselves. I’m not saying you can’t have cable TV; I’m saying let’s honestly separate our actual needs from our wants.

Be honest with yourself

There is a reason cable television providers are struggling to stay in business with the vast array of low-cost streaming options on the market. If there are areas in your budget you think you could cut back on, do yourself a favor and give it a try. In a worst-case scenario, you can add the expense back into your budget the next month if you can’t live without it.

The idea here is, on paper, to cut out all of your wants, also known as discretionary expenses, and start with your needs. If you do this and have a substantial amount of money left over from your income, you can add a want or two so you don’t lose your sanity each month. But remember, the focus is to get that emergency fund up to $2,000 as quickly as possible so you can finally get the ball rolling to get out of debt or start working on your other budget goals.

Setting the pace

If you decide to eliminate all of your wants next month until you get that emergency savings in place, I applaud you – that’s precisely what I would do. If you have little to no money left after your needs, it may be time to downsize your house, sell that truck that costs you $700 a month, or the boat that sits in the garage.

This is about being honest with yourself. Many of us make monthly payments on stuff we don’t need. The idea is to get as bare-bones with your expenses so you can add things that add value to your life.

I also wrote an in-depth guide to help you save money on everyday expenses! Check it out here: The Ultimate Guide To Save Money!

Pro tip: Use a cash envelope system to make it even easier to stick to your budget!

You Need Fun Money To Stick To A Budget And Pay Off Debt

Depending on the amount of your debt, you need to make a reasonable decision on how much fun money you get a month. If you are drowning in debt, your fun money may only be $10 or $20 bucks a month. It depends on how badly you want out of debt.

Fun money is a certain amount you budget in each month to spend on whatever you want. It allows for a guilt-free reasonable splurge each month to keep your sanity. Your budgeted fun money may only be enough for one cup of coffee a week, but at least it gives you an excuse to spend money on momentary gratification.

Step 4: Use Your Budget To Get Out Of Debt

When you get your emergency fund built up, the next step is to use your budget to get out of debt. There are different strategies for paying off debts. Some suggest the best way for debt repayment is to pay off the debt with the highest interest rate, while others suggest paying off the smallest debt first and moving down the line.

For a deeper dive into different debt payoff strategies, refer to my article on Simple Steps To Start Your Debt Free Life to find the best process that matches your personality.

Paying the highest interest rate makes the most sense mathematically but not psychologically. Paying the smallest debts first has been shown to keep people enthusiastic and help avoid losing hope or motivation.

Debt Snowball or Debt Avalance?

I also wrote an article that compares the two main ways to pay off debt. The debt snowball process will keep you motivated, but the debt avalanche method will pay your debt faster. Find out which method is better for you by reading my related article: Debt Snowball Or Debt Avalanche? Which Is Better?

Either way, you should always make the minimum payment on all of your debts except the one you are trying to pay off. By paying off one debt at a time, you will have a laser focus approach that will quickly get you out of debt.

These are the first steps in the budget process. You need to decide where you are going to spend your money each month. If you allocated $600 for groceries, then don’t spend more than $600. An easy way to avoid overspending is to take $600 out in cash each month, and when the money is gone, it is gone. Credit cards make it too easy to overspend. Swiping hurts much less than handing over cold hard cash.

Step 5: Fully Funding Your Retirement Account

The final step after your debts are paid involves investing. Aim for at least 18% of your net income to go towards your retirement account. If you feel like challenging yourself, try investing 18% of your gross income (before tax income) instead.

When you are debt-free, increasing your net worth by decreasing your monthly spending limit and increasing your monthly savings goals will allow you to take advantage of compound interest. Being able to see the bigger financial picture and making regular contributions to your retirement savings.

How Do You Create A Yearly Budget?

The truth is, our lives are continually changing, and our expenses change monthly. If you attempted a yearly budget, you would quickly find yourself either saving more money than you intended (yay!) or spending more money than you brought in (more likely). It’s not worth the risk of setting up a budget once a year and hoping for the best.

Budgets can be tedious for the first couple of months, but after you get the hang of it and better understand how to manage your money, the process will become much easier and faster.

What If Your Income Is Not Enough?

Sometimes you can cut back on everything, and there is still not enough money coming in. If this is the case, you may have an income problem rather than a spending problem. Luckily, in today’s gig economy, it’s easy to find a part-time job that can increase your monthly income each month if you’re willing to pick up a side hustle.

Side gigs, such as freelance writing or food delivery services, can be the easiest ways to give you a financial cushion and increase your budget surplus.

Common Budgeting Mistakes

- Thinking a rewards card with a balance is a smart money tactic

- Buying expensive things that don’t bring value to your life

- Failing to track daily spending

- Missing a payment and having to pay unnecessary late fees

- Forgetting occasional expenses such as birthdays and holiday gifts

Budgeting Tips

- If you have a large expense coming up, use a sinking fund to pay for it with cash

- Continue to improve your financial literacy by reading financial blogs

- Use a budgeting app to track spending in real-time

- Refer back to your budgeting goals often

- Use a money goal coloring sheet to stay motivated

- Eliminate high-interest loans as soon as possible

- Learn about the 50/30/20 Rule

- Use my budget calculator to add up expenses quickly

- Don’t spend leftover money

Wrapping It Up

As you start this process, for your own sake, refuse to give up. If you’re serious about taking control of your life and changing your future, start making significant cuts to your expenses. The truth is, you’re bleeding. Some of you may be hemorrhaging money. It’s time to stop the bleeding.

It’s time to tell your money where to go and to stop losing the battle to marketing schemes, and on junk you don’t need. You can win this war – I promise. I will walk with you; please feel free to reach out to me for encouragement!

from Arrest Your Debt https://ift.tt/2ZRtupD

via IFTTT

Comments

Post a Comment